Extreme weather conditions pose a significant threat to transportation safety in Europe. Hailstorms, dense fog, snow and ice, heavy rain, and high winds each contribute to increased accident rates and costly damages for passenger cars, commercial trucks, and even yachts. CASCO (comprehensive) insurance data reveal substantial financial losses from weather-related incidents, underlining the need for proactive measures. This report analyzes how these severe weather conditions impact accident frequency and insurance claims, quantifies the economic damage across Europe, and evaluates the potential of real-time nowcasting weather alerts (such as those by iklim.co) to reduce accidents and losses. We also propose business models to integrate insurers into an alert ecosystem – from revenue-sharing to risk-adjusted premiums – making a persuasive case for automotive and logistics companies to adopt dashboard weather alert systems.

Weather Conditions and Accident Rates in Europe

Adverse weather conditions significantly increase the risk of accidents on both roads and waterways. Studies consistently show that rain, snow, fog, and wind lead to more frequent and severe crashes. A meta-analysis of 34 studies found that on average rain increases crash rates by ~71% and snowfall by ~84%. In Germany, roughly 10% of all car accidents are directly attributable to weather, and in high-speed or winter conditions this share exceeds 30%. Some estimates even suggest up to 30% of crashes in Europe involve inclement weather. Weather-related crashes are also deadlier: about 8,000 fatalities per year in Europe (≈one-third of road deaths) occur in weather-related accidents, imposing enormous human and economic costs. Below we examine specific hazards:

Hail: Sudden Storms and Vehicle Damage

Hailstorms can form suddenly and pummel regions with ice, causing hazardous driving conditions and extensive vehicle damage. Drivers caught in a hailstorm face shattered windshields or loss of control, and parked vehicles can be dented or totaled. Hail is “by far the greatest contributor worldwide to insured losses from severe convective storms”, often exceeding tornado or wind damage. In Europe, hailstorms regularly result in tens of thousands of auto insurance claims. For example, a July 2023 hail outbreak in Spain and France produced hailstones up to 11 cm in diameter and damaged over 1,000 vehicles at a single car factory in Basque Country – part of an event expected to generate hundreds of millions of euros in insured losses. Similarly, Italy experienced €5.5 billion in hail-related losses in 2023, the highest ever for a European convective storm event. Passenger cars bear the brunt of hail (roofs and hoods dented, glass shattered), but trucks can also sustain trailer and cargo damage. Yachts and boats, if caught in hail, may incur cracked decks, broken equipment, or hull damage. Insurers report that hailstorms happen yearly across Europe, with major outbreaks causing up to billions in claims in a single year (as seen in Germany 1984 and 2013).

A large hailstone measuring ~8 cm across. Hailstorms can suddenly strike, pelting vehicles and boats with ice and causing severe physical damage. Hail is one of the costliest weather hazards for insurers, often leading to thousands of auto claims in a single storm.

Fog: Low Visibility and Multi-Vehicle Collisions

Fog is a hidden killer on highways. Dense fog drastically reduces visibility, sometimes to only a few meters, giving drivers little time to react. The result can be multi-vehicle pileups, often involving high speeds and severe outcomes. Notorious examples include the 160-vehicle pileup on the M42 in England (1997) and a 200-car collision in Belgium (1996) under foggy conditions. Such fog-related crashes have caused dozens of fatalities and hundreds of injuries in single incidents. Trucks are frequently involved – a fast-moving truck in fog can trigger a chain reaction crash with devastating impact due to its mass. In European accident statistics, fog accounts for a smaller fraction of total crashes (e.g. ~1% of fatal crashes in EU data), but when fog accidents occur they tend to involve many vehicles and high costs. A single fog disaster can result in millions of euros in vehicle losses and insurance claims due to the sheer number of vehicles damaged. CASCO insurers face large payouts from such pileups, as dozens of vehicles (personal cars and commercial trucks alike) may be written off in one event. Proactive fog alerts and highway fog warning systems have been introduced in some fog-prone areas to slow traffic – a response to past tragedies where fog warnings were not activated in time.

Snow and Ice: Winter Road Hazards

Snowfall and ice create perilous driving conditions, especially in northern and alpine regions of Europe. Slippery roads (black ice, packed snow) dramatically increase braking distances and cause loss of control, leading to surges in accidents during winter storms. The risk of crashes in snowy/icy weather is nearly double that of normal conditions. In Germany, severe winter months (e.g. January/February 2010) saw unusually high accident counts due to snow and black ice on roads. Trucks are particularly vulnerable – single-truck crash rates spike under snow, as heavy lorries can jackknife or slide on inclines. In fact, one study found single-truck crashes increased the most under snow, more than any other crash type. For passenger cars, minor fender-benders and single-car spinouts also multiply in snow (often with less severe injuries as drivers slow down in visible snow). The insurance impact is significant: winter storms bring waves of claims for vehicle collision damage and some 7% of all German motor insurance claims by cost are due to winter storm hazards on average. Snow can also affect yachts in port – for instance, sudden freezes or snow squalls can jeopardize smaller vessels’ stability or cause infrastructure damage (frozen lines, iced docks). However, maritime incidents from snow are rarer than road accidents. Overall, timely road salting, snow plow operations, and public warnings are key to mitigating the spike in crashes during snowstorms.

Heavy Rain: Downpours, Flooding and Hydoplaning

Rain is the most frequent bad weather condition drivers face, and it consistently elevates accident risk. Even moderate rain can cause hydroplaning (tires losing grip on waterlogged pavement) and increase braking distance. The meta-analysis noted above found a ~71% average increase in crash likelihood during rainfall. Critically, while rainy conditions increase crash frequency, they sometimes reduce average severity (drivers may slow down, resulting in fewer high-impact crashes). Nonetheless, rain was a factor in about 11% of fatal crashes EU-wide in recent stats, making it a major contributor to road risk. In particular, summer cloudbursts and thunderstorms can catch drivers off-guard: urban areas experience treacherous ponding on roads, and on highways sudden downpours can trigger chain collisions. Beyond collisions, flooding from heavy rain causes extensive vehicle damage. Urban flash floods (like the 2021 floods in Germany and Belgium) inundated thousands of cars – nearly 20,000 vehicles were ruined in the 2021 Ahr valley flood, contributing to €460 million in vehicle insurance claims. Across Europe, flood-related vehicle losses have grown with more extreme rainfall; insured flood losses in urban Europe were almost $5 billion in 2023 (property + auto). Yachts and boats also suffer in heavy rain mainly when accompanied by storms – marinas can flood, and runoff can damage engines or interiors. For instance, in late 2023 a storm surge and torrential rain on the Baltic coast led to hundreds of yachts breaking from moorings, colliding or sinking. CASCO insurance covers many of these peril types, but the surge in claims after major floods or cloudbursts has insurers pushing for better early warning and prevention (e.g. encouraging drivers to move cars to higher ground when alerts are issued).

High Winds: Storm Gusts and High-Profile Vehicle Risks

Severe winds – whether in coastal windstorms or thunderstorm gust fronts – pose unique dangers. Strong crosswinds can blow vehicles off course; high-profile vehicles like trucks, buses, and vans are particularly susceptible. On highways and bridges, gusts have overturned trucks or pushed them into other lanes, causing crashes. Research confirms that trucks are especially vulnerable to high winds, which double the crash risk for single-truck accidents under extreme wind conditions. There are numerous cases of trucks toppling in Europe during windstorms (e.g. during winter storm “Ciara” and others, highways saw lorries blown over, leading to road closures and insurance claims for wrecked cargo and vehicles). For passenger cars, wind can contribute to accidents indirectly – by blowing debris or even felling trees onto roads. Drivers who are unaware of gale warnings might cross exposed viaducts where sudden gusts lead to loss of control. Meanwhile, yachts and maritime craft are heavily affected by high winds. Gale-force winds can turn a routine voyage perilous: sails can tear, boats capsize, or get dashed against docks. An example is the October 2023 Baltic Sea storm surge, where hundreds of moored yachts broke loose in hurricane-force gusts, with over 200 total losses reported. In that event, marinas were devastated – individual yacht damages often reaching five or six figures each. Marine insurers cover windstorm damage (hull insurance), but extreme wind events drive up loss ratios. On land, insurers also note that pure wind-caused auto crashes are less common than hail or flood – however, wind contributes to multi-peril events (storms that include wind, hail, rain) which in sum accounted for a majority of Europe’s catastrophe motor insurance losses in recent years. In short, high winds are a serious but somewhat underestimated accident factor – requiring alerts (e.g. warnings to trucks to stay off certain routes) to prevent disasters.

Financial Damage and Insurance Data for Weather-Related Losses

CASCO insurance claims data from across Europe underscore the massive financial toll of weather-related accidents and damage. Motor insurers and marine insurers alike have to pay out for these “acts of nature” on a regular basis, and the costs are rising with climate change trends. Below we present key figures illustrating the economic impact:

- Annual Weather Claims in Motor Insurance: In Germany (a bellwether market), an average year sees around €1 billion in auto losses from natural hazards (storms, hail, floods). This can fluctuate greatly—2022 saw €0.9 billion (a mild year), whereas 2021 reached €1.8 billion due to major floods. Preliminary data for 2023 show €1.92 billion in vehicle storm/flood losses (470,000 hail/wind claims + 4,600 flood claims). These swings reflect the occurrence of extreme events in a given year. Over the past decades, peak years have incurred enormous costs: for example, the 1984 Bavaria hailstorm outbreak led to €3.35 billion in vehicle damage, and a series of storms in 2013 cost €2.75 billion for German motor insurers. In comparison, even the catastrophic Europe floods of 2021 resulted in a lower auto loss (hundreds of millions) than those hail disasters.

- Trends Across Europe: Europe as a whole has seen a spike in convective storm losses. The Swiss Re Institute reports that severe convective storm (SCS) losses have exceeded $5 billion in Europe each year for the past three years, and are growing at the fastest rate globally in Europe. A large portion of these losses comes from vehicle damage (hail smashing cars, wind toppling vehicles) alongside property. Additionally, Europe experienced over $100 billion in economic losses from all natural catastrophes in 2023, the highest of any continent, with storms and floods as key drivers. This highlights that weather-related damages are not a minor or isolated issue but a mainstream risk to businesses and individuals.

- Maritime (Yacht) Insurance Losses: In the marine sector, insurers also note substantial weather impacts. One major insurer (Travelers) found that nearly 1 in 5 boat/yacht insurance claims (19%) were due to severe weather – making weather the second-largest cause of loss after collisions. Storms can destroy marinas and vessels: for instance, a Baltic storm surge in 2023 caused “many millions of euros” in yacht damages in one weekend. Historical storms show similar patterns; even in well-prepared regions, a single hurricane-force windstorm can wreck dozens of boats. While comprehensive statistics on European yacht losses are harder to come by (claims tend to be localized to coastal disasters), anecdotal evidence abounds. In one German insurer’s report, wind, rain, and hail are listed as covered causes in virtually all yacht hull policies, precisely because these perils regularly lead to claims ranging from minor repairs to total losses.

Taken together, the data confirm that severe weather events cost billions of euros every year in vehicle and yacht damages across Europe. Insurers are keenly aware of this burden. It is telling that storm, hail, and flood now make up ~70% of insurers’ natural catastrophe payouts in some portfolios, and innovative solutions are sought to curb these losses. The figure below illustrates some of the largest weather-related vehicle insurance losses in Germany for select years, highlighting the spikes caused by extreme events:

Weather-related insurance losses in Germany (motor vehicles) for 2023 vs. peak historical events. In 2023, €1.92 billion in auto losses came from 470k storm/hail claims and 4.6k flood claims. This was significant, though still below the record €3.35 billion of 1984’s catastrophic hailstorm and €2.75 billion in 2013. 2022 was a quieter year (€0.9 billion). Such data underscores the volatility of weather losses and the high stakes for insurers.

(Sources: GDV / Insurance Association data)

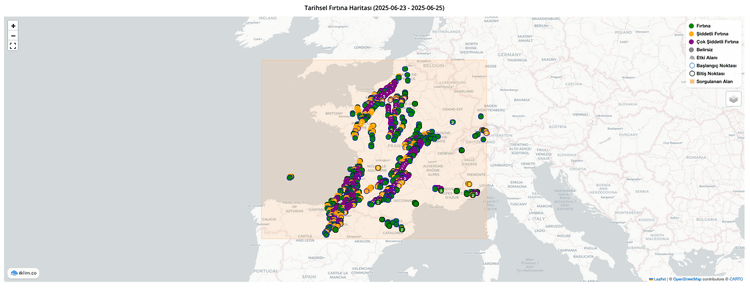

The Case for Real-Time Nowcasting Alerts

Given the clear link between severe weather and accidents/damage, a proactive approach is crucial. Real-time nowcasting weather alerts provide minute-by-minute, hyper-local warnings of impending hazards – and evidence shows they can significantly mitigate accidents and losses. Modern nowcasting systems (like those offered by iklim.co) use radar, satellite, and IoT data to predict hazards (hail, heavy rain, fog banks, wind gusts) in the next few hours with high precision. Integrating these alerts into vehicle dashboards or fleet management systems allows drivers and operators to take preventive action before dangerous conditions strike.

Proven Safety Benefits of Early Warnings

Early warning systems save lives and reduce damage by influencing behavior. When drivers receive timely alerts about hazards ahead, they can slow down, reroute, or seek shelter. For example, a study of the U.S. Wireless Emergency Alerts system for flash floods found that sending alerts to drivers reduced traffic accidents by ~15.9% during those extreme weather events. The alerted drivers presumably adjusted travel (indeed, traffic volume dropped ~3% right after alerts, indicating people pulled over or delayed trips). This is a remarkable real-world reduction in crashes attributable solely to real-time warnings. Similarly, a long-term analysis of NOAA weather radio expansions found counties with alert coverage saw nearly 40% fewer injuries and 50% fewer fatalities from severe weather incidents, compared to those without coverage. These statistics underscore that prompt warnings translate to avoided accidents and saved lives.

Road safety researchers concur that on-board weather alerts and “impact-based warnings” can improve driver decision-making. A 2022 European study recommends situation-specific on-board warnings for weather as an important next step in traffic management, noting that including meteorological data in driver information systems can markedly improve predictive safety models. In essence, if a vehicle “knows” there is ice on the road 5 km ahead or a sudden fog bank forming, it can warn the driver to slow down or the autonomous system to adjust. Several European countries already employ variable message signs and smart speed limits on highways when fog or ice is detected – nowcasting can bring this intelligence directly into each vehicle, personalized to its location and route.

For maritime contexts, real-time alerts are equally vital. Boaters often rely on nowcasts for lightning, squalls, and gale warnings. Platforms like iklim.co have demonstrated that early storm tracking and alerts enable authorities and individuals to prevent disasters. Early warnings gave people time to secure boats in harbor and avoid going out to sea, likely “saving lives and reducing damage”. This level of responsiveness – getting an immediate alert that, say, “Severe thunderstorm with large hail arriving in 15 minutes” – allows both motorists and mariners to act in ways that blunt the impact (seeking shelter under an overpass or harbor canopy, postponing departure, etc.).

Integration into Vehicle Dashboards and Logistics Systems

To maximize effectiveness, nowcasting alerts should be integrated directly into the tools drivers and operators use – vehicle infotainment or navigation screens, fleet dispatch software, and logistics planning platforms. When an alert is displayed on a car’s dashboard (audibly and visually), it can catch the driver’s attention more effectively than a radio report or phone app that might be overlooked. For commercial trucks, integration with telematics means dispatchers can receive high-wind or blizzard alerts along a route and instruct drivers accordingly (or the onboard system can automatically recommend a safer route). Many modern vehicles already have connectivity and screen infrastructure that can support this.

Automakers and trucking companies should view weather alerts as an extension of advanced driver-assistance systems (ADAS). Just as cars now have forward collision warnings or lane departure alerts, weather threat alerts are a form of situational awareness that can prevent accidents. Imagine a truck’s dashboard flashing “WARNING: Extreme crosswind gusts on bridge ahead – reduce speed” based on live nowcast data. This could prevent a rollover. Or a car navigation that reroutes you because “Torrential rain and flash flooding reported on current route” – preventing you from driving into a flooded underpass. These are not future fantasies; the data and technology exist today.

From a logistics standpoint, companies can leverage nowcasting to optimize operations around weather. For example, if a fleet management system knows a hailstorm will hit a certain area in 30 minutes, it can direct drivers to pause in a safe location or take cover, avoiding mass vehicle damage (hail claims often total thousands of euros per vehicle). Insurers have estimated that proactive measures like this could prevent a large portion of the $84 billion in annual storm losses worldwide. Indeed, iklim.co’s mission is explicitly to “decrease storm-related payouts” by giving insurers and their clients the tools to act ahead of weather.

Real-time nowcasting in dashboards also aligns with public safety initiatives. National meteorological services in Europe are moving toward impact-based warnings, which focus on conveying what actions people should take. On-board alerts can be the ultimate impact-based warning: personalized, location-specific, and actionable in the moment. This proactive approach turns weather from a passive hazard to an active piece of data in the driver’s decision loop.

Business Models for Integrating Insurers into the Alert Ecosystem

To implement real-time weather alert systems at scale, collaboration between automotive firms, logistics operators, tech providers, and CASCO insurance companies is key. Insurers have a vested interest in reducing claims, and they can leverage their role to encourage adoption of nowcasting tools. Below are potential business models and partnership frameworks:

- Risk-Based Premium Incentives: Insurers can offer discounts or lower premiums to vehicle owners and fleet operators who integrate approved weather alert systems. Much like telematics-based insurance rewards safe driving, policyholders could get reduced CASCO premiums if their vehicle is equipped with a certified nowcasting alert service (or if they routinely heed warnings). The logic: these drivers will have fewer weather-related claims, justifying the discount. Insurance companies already use risk-based pricing; integrating real-time risk mitigation could be the next step. For example, an insurer might analyze that clients receiving hail alerts filed significantly fewer hail damage claims – and thus offer, say, a 5% premium reduction for subscribing to the alert program.

- Revenue Sharing with Alert Providers: Under this model, insurers partner with weather-tech firms (like iklim.co or others) and possibly automakers to embed the alert systems, and agree on sharing the financial benefits. If the alerts lead to fewer claims (claims cost reduction), the insurer shares a portion of the saved losses as revenue to the tech provider or as rebates to the automaker/fleet. This could involve upfront fees paid by insurers to nowcasting services in exchange for broad access for their customers. Essentially, the insurer invests in prevention, accepting a short-term cost for long-term payout savings. A real-world analogy is how some insurers subsidize burglar alarms for homeowners; here they might subsidize the weather alert subscription in each vehicle. The $84 billion global storm loss figure suggests even a small percentage reduction in losses is worth tens of millions – plenty of value to share.

- Co-Branded Safety Programs: Insurers and auto manufacturers could co-create safety programs where weather alerts are a value-added service for customers. For instance, a CASCO insurer could bundle a premium vehicle weather alert app for free with every policy. The app (powered by nowcasting data) warns the driver of imminent hail or extreme weather. In return, if the driver acts (e.g. confirms they sought shelter), the insurer might waive the deductible on any residual damage or provide other perks. This creates a win-win: drivers feel taken care of (“my insurer helps protect me proactively”), and insurers reduce claim severity. Automotive companies could join in by building the interface into the car – perhaps even an insurance-sponsored firmware update that adds weather alerts to older connected car models.

- Claims Reduction Bonuses: In commercial fleet insurance, insurers could set up agreements where if a logistics company reduces weather-related claims below a certain threshold (with the help of alert tech), the insurer pays a bonus or refunds part of the premium. This model aligns incentives: the fleet benefits by both avoiding downtime/damage and getting a financial reward, while the insurer benefits from fewer payouts. Achieving the target would likely require the fleet to actively use route nowcasting – for example, re-routing trucks around a forecasted blizzard or pausing operations during a fog advisory. Telematics data can verify compliance (e.g. the system records that drivers acknowledged alerts or altered routes). This is analogous to safe driving rebate programs, but focused on weather adaptation. Such incentive schemes could spur adoption of nowcasting dashboards in logistics firms as a standard operating procedure to hit those claim reduction goals.

- Data-Sharing and Underwriting Partnerships: Another model is deeper integration where insurers integrate nowcast data into their underwriting and claims processes. For example, insurers could use real-time weather telemetry to temporarily adjust coverage or trigger warnings. A potential product is dynamic deductibles – if an insured driver receives a severe weather alert and responds (doesn’t drive, or moves the car to safety), the insurer could promise a lower deductible if a claim still occurs. On the flip side, if a driver ignores repeated weather warnings and has a preventable claim, that could influence their risk profile (much as multiple at-fault accidents would). These nuanced models would require careful design to remain fair, but they illustrate how integrated data can create new insurance products. Insurers might pay weather service providers for live data feeds into their systems to enable such features (e.g. automatic claim filing triggers when a customer’s geolocation is within a hailstorm footprint, etc.).

In all these models, the core principle is aligning the insurer’s loss-prevention interest with the customer’s safety interest. By sharing savings or offering carrots (discounts, rewards), insurers can drive the adoption of nowcasting alerts. Automotive and logistics companies, in turn, gain not just safer operations but also financial benefits (lower premiums, fewer disruptions). This collaborative ecosystem transforms what used to be a reactive stance – paying for wrecks after weather strikes – into a proactive one where everyone works to avoid the damage in the first place. Given that weather extremes are expected to intensify, such partnerships will be increasingly valuable.

Conclusion

Severe weather is a critical risk factor for transportation in Europe, but it is a risk we can manage better. The data show unequivocally that hail, fog, snow, rain, and wind lead to more accidents and hefty economic losses – running into billions annually in vehicle and yacht damage. However, by harnessing advanced nowcasting technology and integrating real-time alerts into vehicles and logistics systems, we have the tools to significantly reduce these accidents and claims. Early warning systems have proven their worth in cutting crash rates by prompting timely action.

Automotive manufacturers and fleet operators are encouraged to collaborate with insurers and weather intelligence providers to bring this innovation to dashboards across Europe. The business case is persuasive: fewer accidents mean saved lives, less downtime, and lower costs for all parties. A relatively small investment in weather alert integration can yield outsized returns in safety and financial performance. Insurers, for their part, are poised to support these measures through inventive models that reward prevention. Just as seatbelts and ABS became standard to improve safety, nowcasting alerts can become a new standard feature – a “digital safety belt” against Mother Nature’s hazards.

In an era of climate change and increasingly unpredictable weather, proactive adaptation is not just advisable – it is essential. By integrating real-time weather alerts and forging partnerships around them, Europe’s automotive and logistics sectors can stay one step ahead of the storm, literally. The result will be safer roads and waterways, more resilient operations, and a reduction in the human and economic toll of severe weather. It’s time to turn forecasts into actionable alerts and ensure that drivers and captains alike are never caught off-guard by the next hailstorm, fog bank, or gale. The technology is here; the path is clear – and the stakeholders who move first will lead the way in weather-proofing transportation for the future.